1. No Large Upfront Payment 💰

✔️ Leasing does not require a large down payment, unlike buying a car where a 20 percent down payment is mandatory.

✔️ You only need to pay a small security deposit and monthly lease payments.

✔️ Helps expats manage their budget effectively without tying up large amounts of money in a car purchase.

💡 Tip – Many leasing companies offer flexible payment plans, making it easier for expats to get a car without financial strain.

2. Hassle-Free Maintenance & Repairs 🔧

✔️ Leasing includes free maintenance and servicing, so you do not have to worry about unexpected repair costs.

✔️ Covers regular oil changes, tire replacements, and general wear and tear.

✔️ No stress about expensive repairs that come with owning an aging car.

💡 Tip – Always check if your leasing contract includes 24 by 7 roadside assistance for added peace of mind.

3. Comprehensive Insurance is Included 📄

✔️ Leased cars come with full insurance coverage, reducing the hassle of buying your own policy.

✔️ Insurance costs can be high for new car owners, but leasing offers a cost-effective solution.

✔️ If you get into an accident, insurance claims are handled directly by the leasing company.

💡 Tip – Ask about collision damage waivers CDW to further reduce your liability in case of an accident.

4. No Depreciation or Resale Worries 📉

✔️ When you lease a car, you do not have to worry about depreciation.

✔️ Car owners lose money when selling their used vehicle, but leasing lets you avoid resale hassles.

✔️ At the end of the lease, simply return the car and upgrade to a new model.

💡 Tip – Leasing allows you to drive a brand-new car every few years without worrying about resale value.

5. Flexible Lease Terms for Expats 📝

✔️ Lease durations range from monthly, yearly, or multi-year contracts, giving expats the freedom to choose based on their stay.

✔️ Short-term leases are ideal for expats on temporary contracts or business trips.

✔️ Long-term leases offer lower monthly payments and better benefits.

💡 Tip – If you plan to stay in the UAE for less than 3 years, leasing is a more practical option than buying.

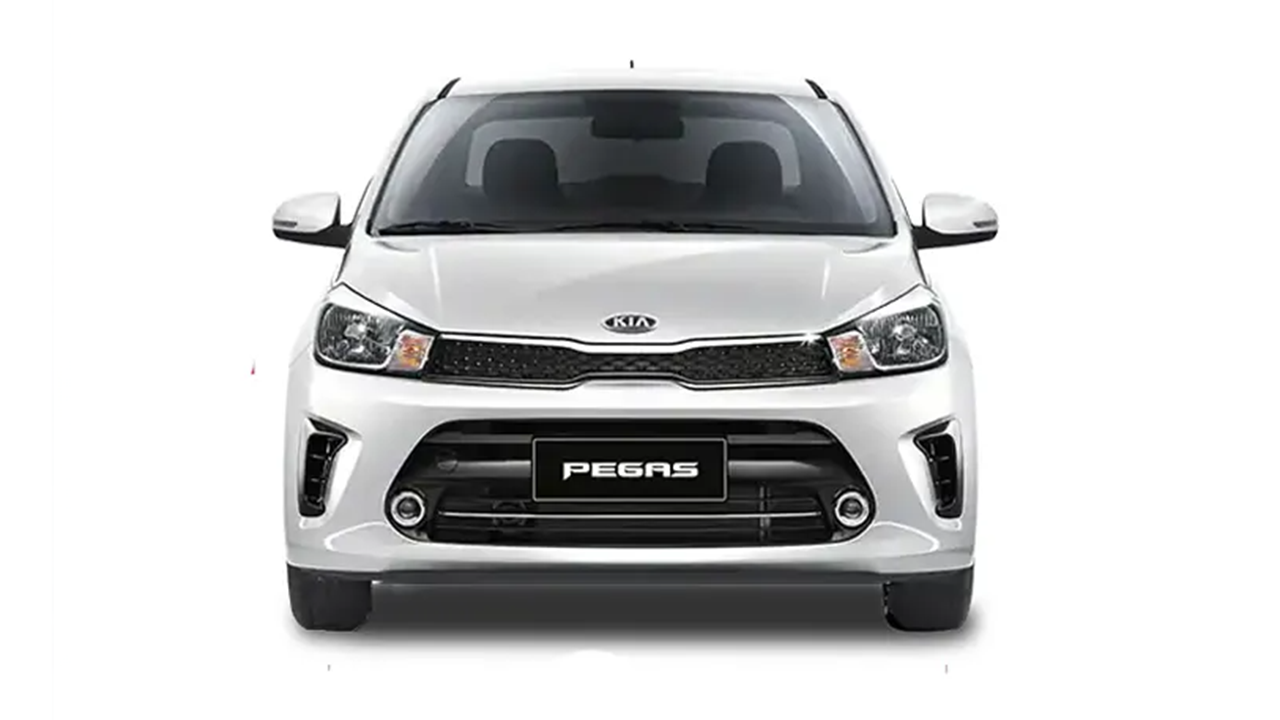

6. Wide Selection of Cars 🚙

✔️ Expats can choose from economy cars, luxury sedans, SUVs, and even electric vehicles.

✔️ Leasing gives you access to top brands like Toyota, BMW, Mercedes, Audi, and Tesla.

✔️ If your needs change, you can upgrade or switch cars without financial loss.

💡 Tip – Some companies offer free car replacements if you want to try a different model during your lease.

7. Perfect for Expats with Uncertain Plans 🌍

✔️ Many expats are unsure how long they will stay in the UAE, making leasing the more practical choice.

✔️ If you suddenly move to another country, ending a lease is easier than selling a car.

✔️ No need to deal with car registration renewal, RTA inspections, or long-term financial commitments.

💡 Tip – Look for leasing plans that offer early termination flexibility in case you need to leave the UAE unexpectedly.

8. Tax & Business Benefits for Expats 🏢

✔️ Self-employed expats or business owners can claim leasing costs as a business expense.

✔️ Helps save corporate taxes and bookkeeping costs for company cars.

✔️ Many leasing companies offer special corporate leasing programs for business travelers.

💡 Tip – If you are an entrepreneur or freelancer, leasing can be more tax-efficient than buying a car.

Final Thoughts – Why Leasing is the Best Choice for Expats in the UAE

🚗 Leasing a car is a cost-effective, flexible, and hassle-free option for expats.

✔️ No large down payment or financial burden.

✔️ Maintenance, repairs, and insurance are included in the lease.

✔️ No resale worries or depreciation losses.

✔️ Short-term and long-term lease options available.

✔️ Easier to return or upgrade the car when leaving the UAE.

💡 If you are an expat looking for a stress-free way to drive in the UAE, leasing a car is the smartest choice.

🚘 Ready to lease a car? Explore the best leasing deals and enjoy a worry-free driving experience! 🚘

.jpg)

.jpeg)